2022.08.23

Working as an Attorney Involved in IPOs

- Yusuke Ito

- Attorney and Instructor of Legal Practice, Chuo Law School

1. Introduction

In April 2022, I published a book entitled Initial Public Offering (IPO) Practice and Theory based on my experiences as an attorney involved in listing examinations for the Tokyo Stock Exchange, Inc. (hereinafter, "the TSE"). In addition to being the first book which I wrote by myself, I was able to publish the book from Shojihomu Publishing, which is a publisher I have admired since I was a student taking the bar examination. This made it a very memorable book for me.

Perhaps because there have been few books by scholars and legal professionals regarding the listing system, my book is enjoying very strong sales in the field of specialized books. I am grateful to everyone involved. Also, as an author, I am relieved that there is a certain amount of demand for my book. Even more, publishing the book has allowed me this opportunity to write for Chuo Online. In this article, based on my experiences as an attorney who graduated from Chuo University and is involved in preparations for listing, I will give a brief explanation of the listing system.

An interview article about this book is posted on the Shojihomu Portal. Anyone can read the article without the need to register as a member (as of June 2022). If you have any interest in the publishing process of my book or my work at the TSE, please take a look (Japanese only.)

Details posted on the Shojihomu Portal (shojihomu-portal.jp)

2. Revision of market segments of the TSE

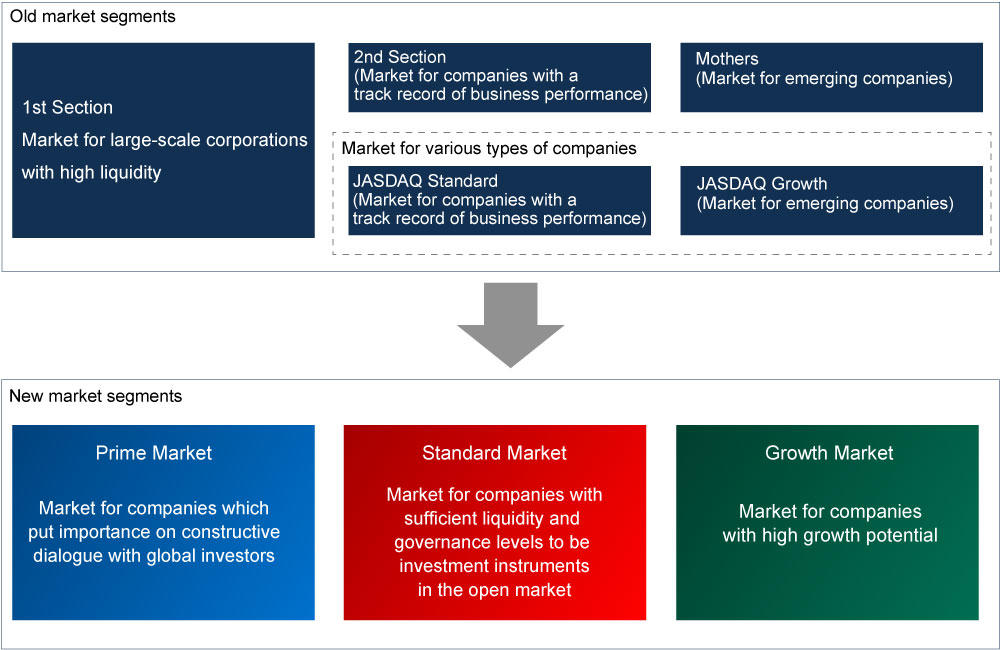

On April 4, 2022, the TSE revised the four market segments of the 1st Section, the 2nd Section, Mothers, and JASDAQ (Standard and Growth) into the three market segments of the Prime Market, the Standard Market, and the Growth Market. This long-anticipated revision of the market segment structure was the result of repeated discussions over a period of several years, and was based on reasons such as the following: 1) the concept and position of the old market segments were vague, 2) the standards for transition from the 1st Section to the 2nd Section and for delisting were low compared to standards at the time of listing, and 3) the market segment structure failed to fully realize its expected role in terms of motivating listed companies to continually improve their corporate value. Until now, the TSE has integrated the markets of the Osaka Stock Exchange into the TSE from the time of its business merger with the Osaka Stock Exchange. However, this restructuring of existing markets to establish new markets is the first such attempt in the history of the TSE and a historical event in the history of financial markets.

The concept of the new market segments are as follows:

(1) Prime Market

For companies which have sufficient levels of market capitalization (liquidity) to be investment instruments for many institutional investors, keep a higher quality of corporate governance, and commit to sustainable growth and improvement of medium- to long-term corporate value, while putting importance on constructive dialogue with investors; the market for companies which emphasize constructive dialogue with global investors.

(2) Standard Market

For companies which have certain levels of market capitalization (liquidity) to be investment instruments in the open market, keep the basic level of corporate governance expected of listed companies, and commit to sustainable growth and improvement of medium- to long-term corporate value; the market for companies which have sufficient liquidity and corporate governance levels to be investment instruments in the open market.

(3) Growth Market

For companies which have a certain level of market value by disclosing business plans for realizing high growth potential and their progress towards these appropriately and in a timely manner, but at the same time pose a relatively high investment risk from the perspective of business track record; the market for companies which have high growth potentials.

3. What does "listing" mean?

The term "listing" is frequently heard, but what kind of image does it bring to mind? The academic definition under the Financial Instruments and Exchange Act is as follows: "Listing is performed for the purchase or sale of securities or for derivative transactions for financial instruments, etc., in a financial instruments exchange market operated by the financial instruments exchange."[1] A simple definition would be that "listing occurs when a securities market targets a certain security for sale on that market."[2]

Now, let's examine the significance and effect of said listing for each party involved. From the perspective of a company that is preparing for listing (hereinafter, "the Applicant Company"), the ability to begin trading of its own securities, etc., in a financial instruments market will make it possible to procure funds. From the perspective of investors, it will be possible to trade securities, etc. issued by the issuing company on the financial instruments exchange. From the perspective of company founders who operate their business, listing is a major milestone which makes it possible to further expand business while receiving founders' profits. It goes without saying that the significance of listing depends on the perspective from which it is viewed.

In practice, the TSE conducts a listing examination regarding the eligibility of a listed company based on the listing application of the Applicant Company. If, as a result of the listing examination by the TSE, the Applicant Company is recognized as being qualified as a listed company, the TSE will issue its approval and announce the listing of the Applicant Company. After that, the shares of the Applicant Company can be purchased and sold on the TSE market through procedures for public offering and sale. At this point, the shares of the Applicant Company are recognized as being publicly listed for the first time.

In this way, the term "listing" is frequently used; however; the meaning changes depending on the position from which the listing is viewed, and the procedures, functions, and effects of listing are diverse. A large number of parties from multiple layers are involved in listing preparation. Achieving a successful listing involves a certain amount of time, cost and human labor, and it is not always a straightforward process

4. Working as an attorney involved in listing preparation

The essential parties involved in listing preparation are the TSE, the lead managing underwriter, and the audit corporation. However, attorneys are also deeply involved in listing preparation as experts. Attorneys mainly support the legal aspects of listing preparation; for example, institutional design of the Applicant Company based on the Companies Act, inspection of the construction and operation of the business management system and internal control system, contractual relations, labor management, taxation, and various advice on legal and administrative guidelines. Furthermore, it is necessary to litigate any proceedings and disputes before listing. Therefore, if the Applicant Company has any legal trouble, attorneys will attempt to resolve the dispute with the other party.

Personally, I also support listing preparations by providing consultation on issues related to listing preparations to clients and securities companies that are preparing for listing. When working at the TSE, I was in a position similar to a referee; that is, I made decisions from the position of an examiner. However, now that I work as an attorney at a law office, I am now in the role of a coach or an advisor to support an Applicant Company. My position is fixed and I am often unable to engage in free judgments and behavior. Even so, my current work has me involved in listing preparations from a position that is closer to a player than a referee. Compared to when I worked at the TSE, this gives me many more opportunities to consider matters through a sense of ownership for the growth of my clients, so I find my current work very exciting and interesting. I am able to assist Applicant Companies in the process of improving their corporate value and achieving sustainable growth over the medium- to long-term, and to help them realize the qualities required to be a listed company. Through my work, I create high-quality listed companies which are part of Japan's financial instruments markets. In this sense, I believe that my work is extremely meaningful because I contribute to the revitalization of the Japanese economy. Moreover, I feel that the breadth and depth of this field makes it suitable as my life's work. I may be overstating my role somewhat; however, as an expert involved in listing preparation, I will continue to do my best to help the capital market develop soundly and fairly. I look forward to supporting companies that are preparing for listing and assisting everyone involved in the market. If I have the opportunity to work with any of my readers, I would appreciate your guidance and encouragement. Thank you very much for taking the time to read this article.

[1] Naohiko Matsuo (2021), Financial Instruments and Exchange Act, 6th Edition, Shojihomu Publishing, p. 519.

[2] Takao Nojiri, Regulations on the Exchange Market, edited by Misao Tatsuta and Katsuro Kanzaki, in Outline of Securities and Exchange Act, 1986, Shojihomu Publishing, p. 426.

Attorney and Instructor of Legal Practice, Chuo Law School

Yusuke Ito was born in Miyazaki City, Miyazaki Prefecture in 1982. He is a counsel partner attorney at Torikai Law Office, an instructor of legal practice at Chuo Law School, a member of the Daini Tokyo Bar Association, and a graduate of the Chuo Law School.

His main fields of work are IPOs, M&A, startup legal affairs, IR, and general litigation.

After joining Torikai Law Office, he worked at the Business Development Department (M&A Advisory Services) of the Development Bank of Japan Inc. and at the TSE (involved in the construction and operation of timely disclosure systems, and in examination for listing) before assuming his current position.

[Main Books]

Initial Public Offering (IPO) Practice and Theory, Shojihomu Publishing, 2022.

Role in the General Meeting of Shareholders for Utilization in Management, co-authored, Shinnippon-Hoki Publishing, 2019.

Practical Measures Learned From Economic Criminal Cases, co-authored, Economic Legal Research Institute, 2015.

[Main Academic Papers]

Outline of Timely Disclosure Systems (Part 1 and Part 2), Journal for Audit & Supervisory Board Members, Issue No. 673 and 675.

Outline and Points of Note for IPO (Initial Public Offering) Examination, Journal for Audit & Supervisory Board Members, Issue No. 709.

Recent IPO (Initial Public Offering) Examinations and Roles Required of Audit & Supervisory Board Members, Journal for Audit & Supervisory Board Members, Issue No. 722.